Table of Contents

Introduction

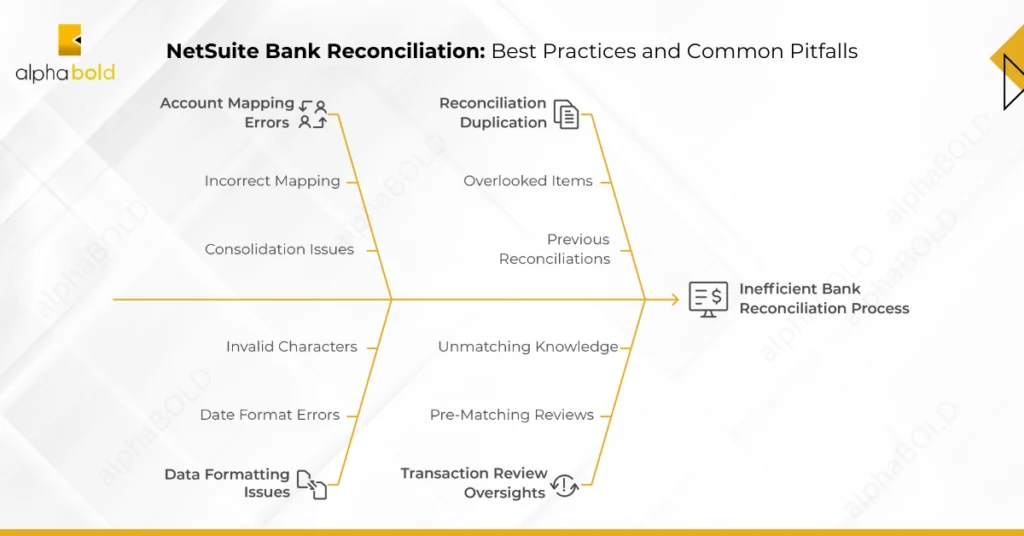

Financial accuracy is critical for businesses of all sizes. A single reconciliation error can lead to misstated financials, inaccurate cash flow forecasting, and compliance risks—resulting in serious operational and regulatory consequences. While the NetSuite Account Reconciliation feature helps streamline accuracy, its effectiveness depends on proper setup and execution. Common issues—such as incorrect bank account mapping, unmatched transactions, and formatting errors in bank data imports—can slow financial close processes and create discrepancies between the general ledger (GL) and bank statements.

A structured reconciliation process is essential to maintaining financial integrity for businesses in industries like manufacturing, construction, and healthcare. This article explores best practices for optimizing NetSuite’s bank reconciliation features, addressing common challenges, and improving financial reporting accuracy.

NetSuite Bank Reconciliation: Best Practices and Common Pitfalls

Accurate bank reconciliation is essential for maintaining financial integrity in NetSuite. However, common mistakes can lead to discrepancies, delays, and inefficiencies. Issues such as incorrect bank-to-GL account mapping, overlooked reconciled items, and formatting errors can disrupt financial accuracy. To streamline the reconciliation process and minimize errors, businesses should be aware of the following best practices and pitfalls:

- Ensure correct bank-to-GL account mapping to prevent mismatched transactions.

- Consolidate deposits in the GL to maintain accurate financial records.

- Use the correct date format when importing bank information to avoid processing errors.

- Check for invalid characters in import files to prevent failures.

- Exclude previously reconciled items to avoid duplication and discrepancies.

- Review transactions before matching in the Review tab to catch inconsistencies.

- Know how to unmatch transactions when corrections are needed.

Further read: “NetSuite ERP Financials: Features, Capabilities and ROI”.

By addressing these challenges, businesses can improve reconciliation accuracy, reduce errors, and streamline financial close processes in NetSuite.

Automate and Optimize Your NetSuite Account Reconciliation

Struggling with bank reconciliation complexities in NetSuite? Our experts can help streamline your processes, automate transactions, and reduce manual errors for a seamless reconciliation experience.

Talk to an ExpertA Step-by- step Guide and Best Practices to Use NetSuite Account Reconciliation Feature

1. Setting Up Bank Connectivity and Account Linking:

Setting up bank connectivity and linking the correct bank accounts can be a challenging task. It is essential to:

- Assign the correct bank account to the appropriate bank link.

- Ensure that the account description includes the last four digits of the account number for easy identification.

- Verify that the subsidiary of the bank account matches that of the link to avoid discrepancies.

2. Matching Deposits to Bank Statements:

A common issue occurs when individual deposits are entered into NetSuite, but the bank consolidates them into a single deposit. To avoid mismatches:

- Ensure that the deposit amount recorded in NetSuite matches the amount posted in the bank statement.

- Reconcile transactions in a way that reflects actual bank activity.

3. Importing Bank Files: Best Practices:

Using the imported bank file feature to mimic bank activity requires precision. Key considerations include:

- The imported file must conform precisely to the NetSuite template, even if certain columns are unused.

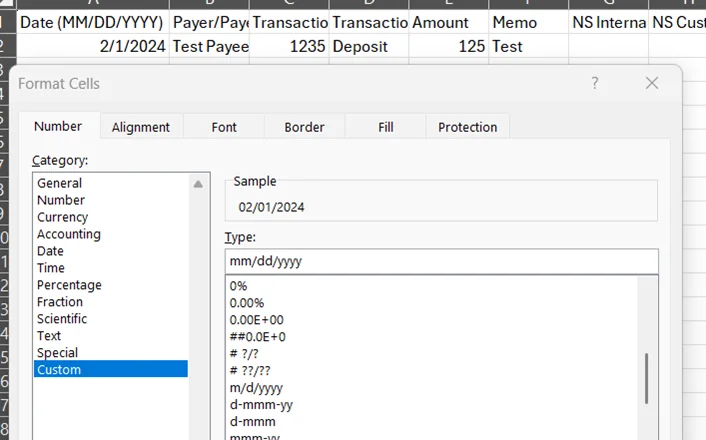

- The date format must match exactly. To ensure compatibility, format the date field in Excel as follows:

- Highlight the date fields.

- Right-click and select Format Cells.

- In the Category field, select Custom.

- In the Type field, enter mm/dd/yyyy.

- Click OK.

This is the best, most effective way to format the date in a way that NetSuite will accept it.

Bonus read: “NetSuite Close Management and Consolidation: Insights from Industry Experts”.

4. Handling Import Failures Due to Memo Field Issues:

Sometimes, bank file imports fail due to unprintable or un-parseable characters in the memo field. To resolve this:

- Use the TRIM() function in Excel to remove unnecessary characters.

- If TRIM() fails, manually adjust the memo field to match the downloaded file format.

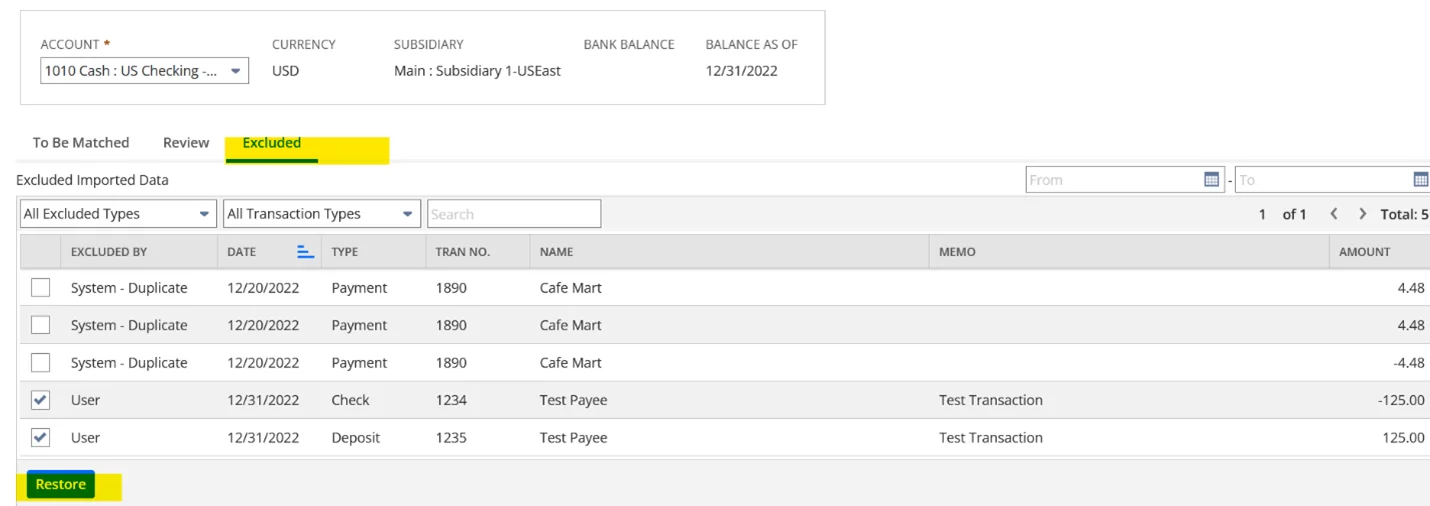

5. Reviewing and Matching Transactions:

NetSuite can automatically match bank transactions with General Ledger (GL) transactions. Before finalizing the NetSuite account reconciliation:

Check the Review tab on the Match Bank Data page to confirm correct matches.

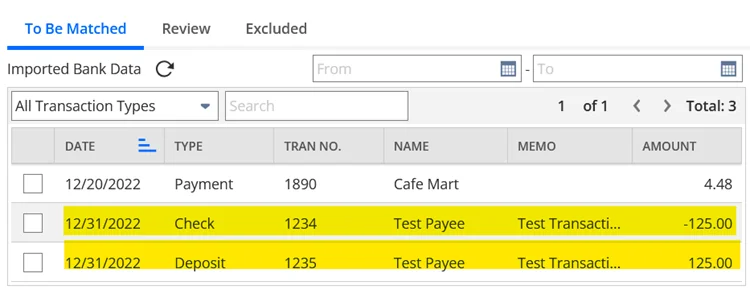

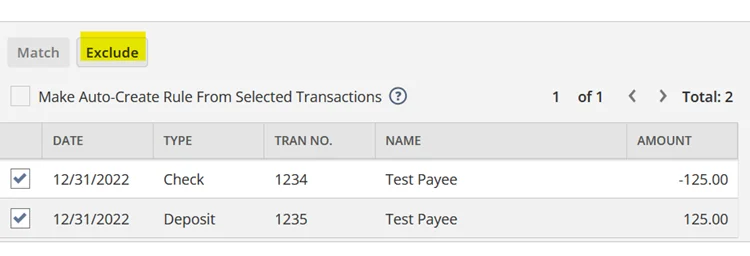

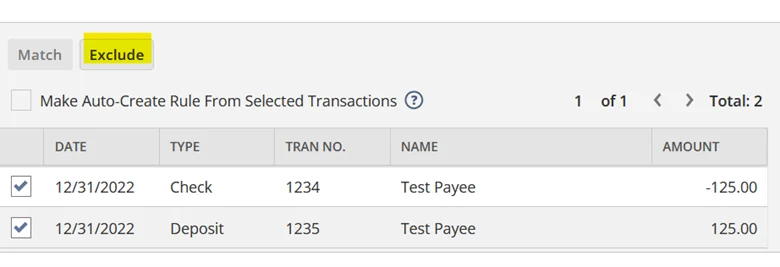

- Exclude any previously reconciled transactions to prevent duplication.

If transactions from previous reconciliations appear in your import, you can:

- Identify the transactions that have already been cleared.

- Select them and click the Exclude button to remove them from the current reconciliation.

3. If necessary, restore excluded transactions back to the un-reconciled list.

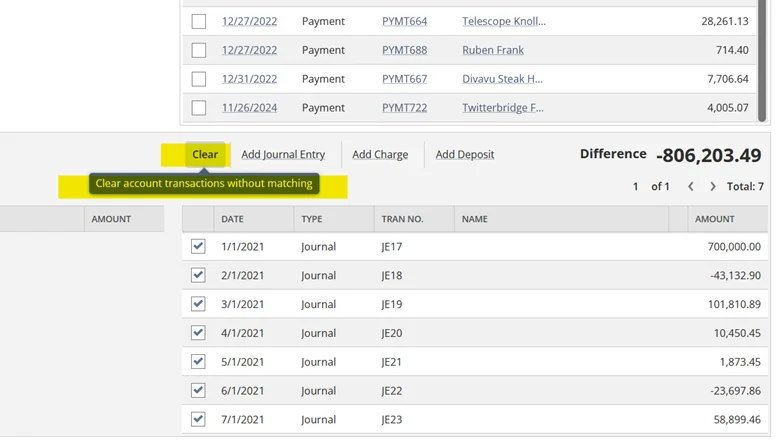

6. Clearing General Ledger Transactions from Previous Systems:

When transitioning to NetSuite, some General Ledger transactions may have been cleared in your previous system. You can:

- Identify previously cleared transactions.

- Use the Clear button to remove them from the Match Bank Data page.

- Proceed with reconciling the remaining transactions as usual.

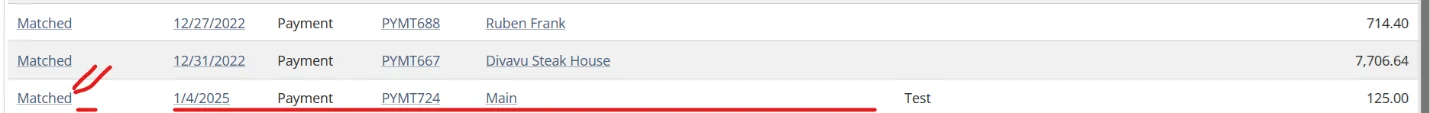

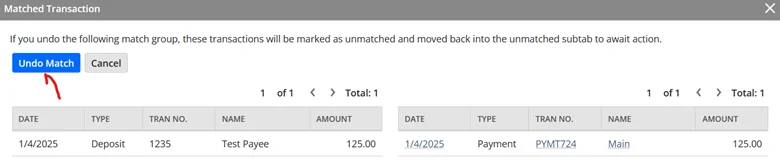

7. Unmatching Incorrectly Matched Transactions:

Occasionally, transactions may be matched incorrectly, either by a user or the system. In such cases:

- Identify the transaction that was mistakenly matched.

2. Click the Match link to open the transaction.

3. Select Undo Match to remove the transaction from the reconciliation.

4. Resubmit the transaction for reconciliation in the correct period.

Enhance Accuracy and Reduce Reconciliation Time

Learn how AlphabOLD's expertise in NetSuite can enhance your financial operations with tailored solutions. Optimize NetSuite account reconciliation today!

Request a DemoConclusion

Effective bank reconciliation is more than just a compliance requirement, it is a strategic financial function that drives business confidence and decision-making. Organizations that adopt structured reconciliation processes within NetSuite gain clear visibility into cash flow, prevent costly errors, and enhance overall financial efficiency.

By applying best practices—such as ensuring accurate bank account mapping, consolidating deposits, and properly formatting imported bank data, finance teams can eliminate reconciliation bottlenecks, reduce manual intervention, and accelerate the financial close cycle. Furthermore, leveraging NetSuite’s built-in automation capabilities ensures that transactions are consistently aligned between bank statements and the general ledger, reducing discrepancies that could impact reporting accuracy.

As businesses continue to scale, financial leaders must prioritize precision in reconciliation processes to maintain control over cash flow and ensure regulatory compliance. Organizations can drive operational efficiency, enhance financial transparency, and position themselves for long-term success by addressing common pitfalls and adopting a disciplined approach to NetSuite reconciliation.

If your organization is facing challenges with NetSuite Account Reconciliation, now is the time to evaluate your processes, implement the necessary improvements, and leverage the full capabilities of NetSuite’s financial management tools. A streamlined reconciliation process today leads to better financial decision-making tomorrow.

Explore Recent Blog Posts