Introduction

The role of finance executives or C-levels extends far beyond traditional financial management. More than ever, they find themselves at the intersection of finance and technology, becoming pivotal players in driving tech decisions that profoundly influence an organization’s growth and efficiency. Therefore, selecting the right Enterprise Resource Planning (ERP) system isn’t merely an IT prerogative but a vital financial strategy. In this vast sea of ERP choices, NetSuite emerges as a beacon for many. It offers robust financial management tools, and its comprehensive suite ensures that organizations are equipped to navigate the intricate nuances of the financial realm. This guide delves into why NetSuite ERP Financial Module, with its unique blend of flexibility, scalability, and financial prowess, is becoming the go-to choice for discerning C-suite and Finance Managers across the globe.

Understanding NetSuite ERP Financial Module

In an era where financial agility can make or break a business, the robustness of an ERP system becomes paramount. With its comprehensive suite of tools, NetSuite stands out in its commitment to fortifying an organization’s financial backbone. Here’s a closer look at how:

Cost Control:

At the heart of astute financial management lies the capability to optimize expenses. NetSuite excels in this domain. Its integrated financial management solutions enabling real-time view of company’s financial position, facilitating rapid, data-driven decisions. Automated workflows reduce manual interventions and associated errors, streamlining processes from procurement to payment. By identifying and eliminating inefficiencies, companies can reduce operational costs and strategically allocate resources for maximum ROI.

Revenue Recognition:

In today’s complex business environment, with its myriad contractual obligations and delivery models, revenue recognition can be a labyrinthine task. NetSuite simplifies this. It offers a robust revenue recognition module that can manage revenue precisely in line with accounting standards. Whether dealing with multi-element sales, subscriptions, or project-based billing, NetSuite ensures that revenues are recognized accurately and timely, thus aiding in compliance and avoiding costly financial restatements.

Consolidated Reporting:

For businesses operating globally, consolidating financial data from diverse operations can be challenging. Disparate systems, varying currencies, and differing regulatory standards can muddy the waters. NetSuite’s consolidated reporting feature is a game-changer here. It provides C-levels with a unified view of global operations, automatically handling currency conversions and abiding by local compliance regulations. The result? A holistic financial perspective that’s both accurate and actionable.

In essence, the financial robustness offered by NetSuite isn’t just about numbers—it’s about equipping executives with a strategic advantage in a competitive landscape. It’s about ensuring that every financial decision is backed by clarity, accuracy, and foresight.

How NetSuite ERP Financial Module Enhances Financial Visibility

In an increasingly unpredictable business world, visibility into financial operations is not just a luxury—it’s a necessity. Financial leaders require a clear lens into the operations of their organization, allowing them to anticipate, strategize, and pivot when needed. NetSuite, with its sophisticated features, promises just this kind of clarity. Here’s how:

Real-time Financial Data:

Timeliness is key in the financial domain. Working with outdated or lagging information can be detrimental, leading to missed opportunities or misguided strategies. NetSuite understands this urgency. Its cloud-based platform ensures that C-levels and their teams always have access to real-time financial data, irrespective of geographic demographics. These real-time insights help C-level make informed decisions, rather than relying on outdated data. Whether it’s a sudden market shift or an unexpected expense, NetSuite’s real-time insights mean businesses can respond swiftly and appropriately.

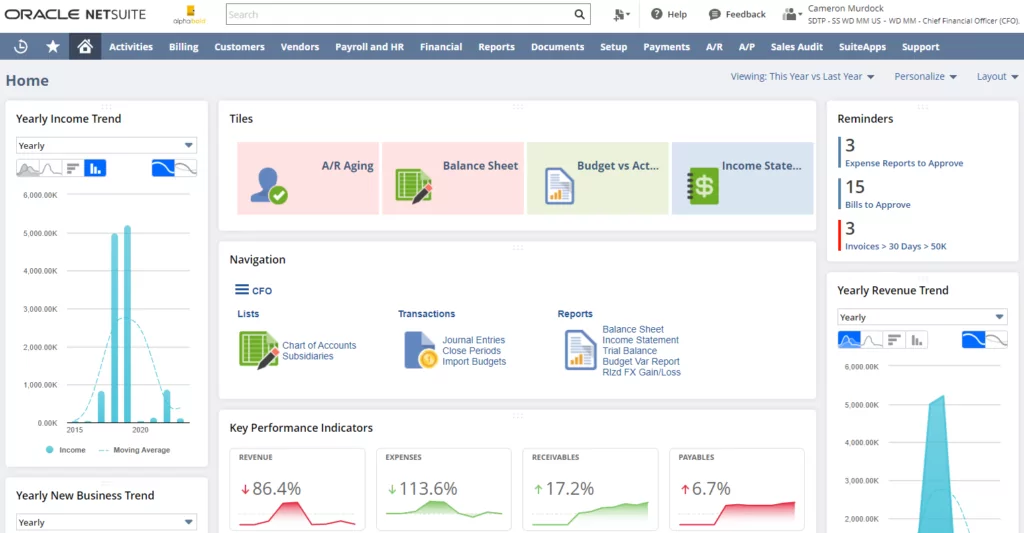

Comprehensive Dashboards:

Information is only as valuable as its presentation. Raw data, without context or structure, can be overwhelming, making it difficult to discern patterns or insights. This is where NetSuite’s dashboards come into play. Designed with the financial leader in mind, these dashboards offer a cohesive, intuitive view of the organization’s financial health. They are customizable, allowing C-levels and finance teams to prioritize metrics that matter most to them, from cash flow statements to sales forecasts. With drag-and-drop functionality, users can easily tailor their views, ensuring that they always have a finger on the pulse of their financial operations.

NetSuite doesn’t just provide data; it transforms it into a strategic asset. By enhancing financial visibility, it ensures that C-levels aren’t just reacting to the market’s ebbs and flows but are, instead, proactively steering their organizations towards sustainable success.

Risk Management & Compliance with NetSuite

In the complex tapestry of modern finance, risk management and compliance don’t just represent operational necessities; they’re fundamental to maintaining trust, integrity, and the long-term viability of an organization. With its forward-thinking features, NetSuite offers businesses a sturdy shield against potential financial pitfalls. Let’s delve deeper into how:

Audit Trails:

In an age where transparency is paramount, maintaining a clear record of financial transactions and modifications is non-negotiable. NetSuite’s audit trail capabilities serve as an organization’s financial diary, meticulously logging every change, approval, or adjustment. Providing a detailed, chronological record ensures that businesses can trace any transaction back to its origin, identifying who made changes and when. This safeguards against potential fraud or errors and bolsters accountability, ensuring that each team member remains responsible for their financial actions.

Global Compliance:

As businesses expand their horizons, venturing into new markets and territories, they find themselves navigating a maze of diverse financial regulations and standards. Each region or country can come with unique compliance requirements, making global operations a potential minefield for finance teams. NetSuite rises to this challenge with its global compliance capabilities. Its system is designed to adapt to various financial regulations, from tax calculations to reporting standards. Whether it’s the General Data Protection Regulation (GDPR) in Europe, the Sarbanes-Oxley Act in the U.S., or any other local regulation, NetSuite ensures that businesses remain compliant, avoiding costly penalties and protecting their reputation.

In essence, NetSuite doesn’t just streamline financial operations—it fortifies them. By prioritizing risk management and compliance, it ensures that C-levels can operate with confidence, secure in the knowledge that their financial house is both resilient and reputable.

NetSuite ERP Financial Module Role in Empowering Business Expansion & Scalability

In the dynamic realm of business, stagnation isn’t an option. Companies perpetually evolve, expand, merge, and adapt to the ever-changing market landscapes. It’s imperative, then, that their ERP system isn’t just a tool for the present but a bridge to their future. NetSuite, with its focus on scalability and growth, positions itself as that bridge. Let’s explore how:

Mergers & Acquisitions:

M&A activities are intricate by nature, often involving the daunting task of integrating disparate financial systems, cultures, and processes. Here, NetSuite emerges as an invaluable ally. Its flexible architecture and comprehensive toolset can seamlessly assimilate the financial data from acquired entities, ensuring that the integration process is smooth and devoid of data silos. This agility means companies can swiftly realize the synergies from their M&A activities, driving value and minimizing integration pains.

Expansion:

As companies cast their nets wider, seeking growth in new markets and regions, they’re often met with the challenges of managing diverse currencies, tax regimes, and compliance standards. NetSuite’s global expansion capabilities are designed to shoulder these burdens. Its multi-currency system automates exchange rate calculations, ensuring accurate financial reporting across regions. Additionally, its tax management module can be tailored to handle diverse tax structures, from VAT in Europe to GST in Asia. This comprehensive approach ensures that as businesses grow, their financial backbone—powered by NetSuite—remains strong, adaptable, and resilient.

To conclude, scalability isn’t just about handling more data or transactions—it’s about evolving with a business, understanding its trajectory, and pre-empting its needs. NetSuite’s focus on scalability and growth ensures that businesses aren’t just equipped for today’s challenges but are primed for tomorrow’s opportunities.

ROI & Total Cost of Ownership (TCO)

When it comes to financial decision-making, C-levels invariably look at the bottom line, evaluating any investment not just for its upfront cost but for its long-term value. In the context of ERP solutions, this translates into a comprehensive evaluation of Return on Investment (ROI) and Total Cost of Ownership (TCO). NetSuite shines particularly bright when examined through these financial lenses. Let’s unpack this:

A Deep Dive into Benefits of NetSuite ERP Financial Module in the Long Run:

One of the standout attributes of NetSuite is its comprehensive, all-in-one suite that minimizes the need for additional software or systems. This inherently reduces the complexity of operations, thereby cutting down costs associated with maintenance, upgrades, and training. Furthermore, the automation and efficiency gains facilitated by NetSuite can translate into substantial labor cost savings and reduced cycle times. Over the long term, these savings can add up, driving a compelling ROI that goes beyond mere numbers, manifesting in streamlined operations and enhanced strategic capabilities.

Comparing TCO of NetSuite Against Other ERP Solutions:

When considering an ERP solution, it’s crucial to go beyond the sticker price and look at the TCO, which includes not just the software and hardware costs but also the expenses related to implementation, maintenance, and potential downtime. Compared to other ERPs, particularly legacy systems that often require significant infrastructure and upkeep, NetSuite’s cloud-based model presents a cost-effective alternative. Its predictable subscription-based pricing, minimal hardware requirements, and reduced need for a large, specialized IT staff make it a financially savvy choice.

AlphaBOLD: A Cost And ROI Guide For your NetSuite Solution

In the dynamic world of business technology, ERP systems have emerged as essential tools to drive efficiency and innovation. Among the leaders in this space is the NetSuite ERP platform, celebrated for its comprehensive solutions tailored for businesses of all sizes.

Request a DemoTo sum up, NetSuite offers more than just an ERP solution; it provides a financially sound investment that pays dividends over the long term. It’s a platform designed with the future in mind, promising operational excellence, a robust ROI, and a favorable TCO, factors that any C-level would weigh heavily in their decision-making process.

Security Aspects Crucial for Finance

In the era of digitization, where data breaches and cyber-attacks have become all too common, financial security is no longer just about safeguarding physical assets. It protects crucial financial data, transactions, and sensitive client information. Recognizing this need, NetSuite has implemented a suite of stringent security measures. Here’s a closer look at how it prioritizes financial data protection:

How NetSuite ERP Financial Module Ensures Data Protection, Especially Concerning Financial Data

At its core, NetSuite clearly understands that financial data is among the most sensitive and valuable assets for an organization. To that end, it employs several layers of security:

Encryption: All data, both in transit and at rest, is encrypted using industry-leading standards. This ensures that any intercepted data remains unreadable and unusable to unauthorized entities.

Role-Based Access: Not all personnel need access to all financial data. NetSuite’s role-based access controls ensure that only authorized individuals can view and modify sensitive information, based on their job responsibilities.

Two-Factor Authentication: An additional layer of protection, this feature requires users to verify their identities in two distinct ways before gaining access, adding an extra barrier against unauthorized access.

Disaster Recovery and Data Backup Solutions:

Even with the best protective measures in place, unforeseen disasters—natural calamities or catastrophic system failures—can threaten data integrity. NetSuite has proactively addressed these concerns:

Regular Backups: NetSuite conducts regular, automated backups of all data. These backups are stored in geographically diverse locations, ensuring that localized issues don’t compromise all backup copies.

Rapid Recovery: In the unfortunate event of data loss, NetSuite’s disaster recovery protocols are designed for rapid restoration. With its cloud infrastructure, data can be swiftly retrieved, and operations can resume with minimal downtime.

Continuous Monitoring: NetSuite’s systems are continually monitored for any anomalies or threats. This constant vigilance ensures that potential issues are detected and addressed proactively, often before they can pose significant threats.

In conclusion, NetSuite’s commitment to security isn’t about implementing protocols and building trust. C-levels and finance managers can rest assured that with NetSuite, their financial data isn’t just stored but is actively protected, backed by robust measures designed to withstand the ever-evolving landscape of cyber threats.

Conquer ERP Selection With Our Free Checklist

Streamline your ERP selection process with our comprehensive checklist, ensuring you make informed decisions for your business's future success.

Learn more

Integration Capabilities for Financial Systems

In today’s interconnected financial landscape, an ERP system’s strength is determined by its standalone capabilities and how seamlessly it can integrate with other tools and platforms. Financial departments often utilize a range of tools—each serving a unique purpose. Whether it’s a specialized accounting tool, a banking system, or a digital payment gateway, the true power lies in making them work together cohesively. NetSuite’s prowess in this domain is noteworthy. Let’s examine its integration capabilities:

Seamlessly Merging with Other Financial Tools:

While NetSuite offers a comprehensive suite of financial tools, it also appreciates that businesses might have pre-existing systems or specific tools they wish to retain. To facilitate this:

Open API Architecture: NetSuite’s robust API allows businesses to create custom integrations with other financial tools. Whether it’s a specialized budgeting tool or a niche forecasting software, NetSuite can be made to communicate effectively with them, ensuring data consistency and flow.

Pre-Built Connectors: Recognizing the popular tools in the market, NetSuite offers pre-built connectors for several financial software solutions, ensuring plug-and-play integration without extensive custom development.

Integration with Banking Systems:

Cash flow management, reconciliations, and fund transfers are daily activities for financial departments. NetSuite simplifies these processes:

Bank Feeds: Automate the process of importing bank statements directly into the ERP. This not only speeds up the reconciliation process but also ensures accuracy.

Secure Data Transfer: Through encrypted channels, NetSuite ensures that financial data transferred between the ERP and banking systems remains secure, mitigating the risk of breaches or leaks.

Syncing with Payment Gateways:

As businesses expand globally, they encounter diverse payment methods and gateways. NetSuite is equipped to handle this diversity:

Multi-Gateway Support: From popular gateways like PayPal, Stripe, and Square to region-specific ones, NetSuite offers integrations that allow businesses to accept a wide range of payment methods seamlessly.

Automatic Reconciliation: Payments received via these gateways can be automatically matched against invoices in NetSuite, streamlining the accounts receivable process and minimizing manual intervention.

To wrap up, an ERP system’s effectiveness in today’s world is significantly enhanced by its ability to integrate. With NetSuite at the helm, businesses can be confident of a system that offers robust in-built features and the flexibility to communicate and collaborate with an array of external financial tools, banking systems, and payment platforms.

Why Choose NetSuite ERP Financial Module to Improve Business Performance?

The modern-day business market is becoming increasingly competitive, forcing businesses to scale at hyper-speed. Business owners are constantly looking for software solutions to help them manage their entire business within one platform. One such solution is NetSuite ERP.

Request a DemoConclusion

In the evolving world of finance, where agility, foresight, and data-driven decision-making hold the keys to success, the role of an ERP system is not just operational—it’s strategic. The modern executive’s purview has expanded beyond traditional financial responsibilities to encompass technology, strategy, and organizational growth. Here, the intrinsic value of a platform like NetSuite comes to the fore.

NetSuite ERP Financial Module is more than just a financial software solution. It’s a strategic enabler, giving C-levels the tools, insights, and agility they need to navigate the turbulent waters of today’s global economy. With its robust financial capabilities, security protocols, seamless integration features, and scalability options, it positions C-levels to manage the present and anticipate and shape the future.

But understanding the real potential of NetSuite isn’t just about reading its features on paper. It’s about experiencing its transformative power firsthand. We strongly encourage C-levels and finance managers to explore NetSuite more deeply, to see how its myriad capabilities can align with their unique business needs and growth ambitions. Schedule a personalized consultation or demo today. Dive into its depths, ask probing questions, and visualize how it can reshape your organization’s financial trajectory.

NetSuite offers stability, foresight, and strategic prowess. Embrace it, and unlock a world of unparalleled financial excellence for your organization.

Explore Recent Blog Posts