NetSuite Close Management and Consolidation: Insights from Industry Experts

Home » Blog » Financial Management » NetSuite Close Management and Consolidation: Insights from Industry Experts

Financial close cycles are among business operations’ most intricate yet critical processes. For years, organizations have relied on manual workflows and fragmented systems, often encountering inefficiencies, delays, and the risk of human error. These challenges have made closing financial cycles time-consuming and resource-intensive, with compliance and accuracy frequently at stake. However, modern tools like the NetSuite Close Management module have emerged to address these issues, offering businesses a way to streamline financial close processes. By automating repetitive tasks, consolidating data in one secure location, and embedding compliance measures, these tools help organizations navigate the complexities of financial management with greater confidence and efficiency.

This blog explores the key challenges of traditional financial close processes and highlights how NetSuite Financial Close Management provides solutions to overcome them. Along the way, we’ll share insights into best practices and strategies, drawing on AlphaBOLD’s experience in helping businesses optimize their financial operations. Let’s start by identifying the common pain points in financial close management.

Further Reading: NetSuite AR Automation: Streamline Cash Flow & Efficiency

Traditional financial close processes often fall short in efficiency and accuracy due to outdated methods and tools. Let’s explore how modern solutions like NetSuite Close Management address specific pain points and improve outcomes:

Traditional close management revolves around manual work, which drains more time and resources. The cumbersome financial consolidation systems are hard to process. Moreover, the close cycle gets longer because financial close management lacks a one-size-fits-all rule.

Therefore, an automated and smooth approach was a burning need, so financial resources could use that time to handle exceptions or review results and reports.

“Most finance functions want to close faster, cheaper, and with fewer errors,”

Pritika Bhattacharjee, VP Gartner Management Consulting Company

Traditional close management carries more risks of security breaches, scams, or missing transactions, making the process obscure and questionable. However, using NetSuite Close Management also resolves this concern.

NetSuite financial close management offers encrypted transaction recording and secure access controls, significantly lowering the risks of fraud or data loss. Its transparent processes foster confidence in financial reporting.

Transparency is a non-negotiable requirement in financial close management, especially when it comes to audit compliance and handling supplementary data. Traditional methods often fall short, leading to misinterpreted or insecure information and increasing the likelihood of errors or regulatory non-compliance.

NetSuite financial consolidation addresses these gaps by introducing workflows prioritizing clarity and accountability. It facilitates effortless audits, implements strict roles, and shows source data behind each figure. NetSuite also supports supplemental data collection by keeping transaction records, invoices, bank statements, and receipts in one place.

Further Reading: A Guide to AP Automation in NetSuite

You can schedule a one-hour discovery call with our NetSuite solution team to explore your implementation, support, or optimization options.

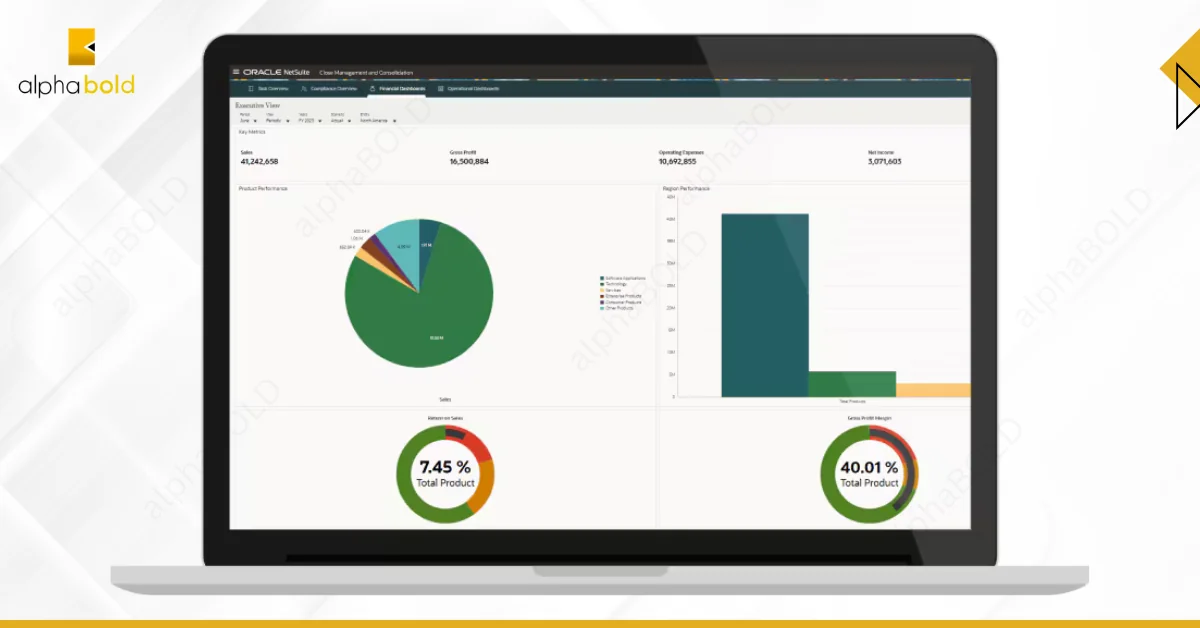

Request a DemoNetSuite Close Management and Consolidation is an all-inclusive portal where businesses of all types can find comprehensive solutions for their financial close cycles. From internal processing to banking transactions and more, it’s a closely allied circuit that prioritizes your secure financial close management.

Now that we understand how NetSuite works, let’s explore some of its key features, which make it a reliable choice for many organizations and enterprises.

NetSuite includes a standardized checklist that ensures close tasks are completed in the correct sequence. This feature helps finance teams avoid delays, maintain consistency, and quickly assess the status of close cycles.

BOLD Tip:

Regularly review your checklist to accommodate new regulations or business changes.

NetSuite consolidation tools support banking integration features to simplify decentralized workflows. NetSuite imports bank statement data and matches it with transaction records. If any transactions are missing, it creates a journal entry and marks them for review by an accounting expert.

When customer payment processing delays arise, they are promptly reflected on the balance sheet. NetSuite automates transaction matching across all accounts, reconciles open invoices, and updates the balance sheet in real time. This significantly minimizes the need for manual intervention, ensuring accuracy and efficiency in financial processes.

For large-scale businesses and enterprises, consolidating finances and records across multiple subsidiaries can be complex and time-consuming. NetSuite acts as a one-stop solution by automating each step from subsidiary-level accounts. This way, NetSuite Consolidation tools save a lot of time and effort.

Financial close cycles occur monthly and can be time-intensive, often taking days. NetSuite Close Management streamlines the process with real-time issue tracking and automation, enabling faster and more accurate closes. Industry experts recommend aligning best practices with close-cycle goals to enhance efficiency and consistency. By focusing on these practices, you can push through these close cycles.

BOLD Tip:

Host regular cross-departmental reviews to ensure alignment and resolve potential issues early.

AlphaBOLD is your NetSuite partner helping businesses achieve their financial goals. From in-depth assessment to efficient optimization, our NetSuite solutions help you every step of the way.

Request a DemoEffective financial close management is critical for maintaining accuracy, compliance, and efficiency. Tools like NetSuite financial consolidation simplify these processes by automating workflows, consolidating data, and providing real-time insights. By adopting such modern solutions, businesses can reduce manual effort, improve reporting accuracy, and focus on strategic financial decisions.

If you’re interested in exploring how the platform can streamline your financial operations, AlphaBOLD offers tailored solutions to meet your unique needs. Schedule a discovery call or request a demo to see how NetSuite can benefit your organization.